Nets’ market insights and comprehensive data points to three trends that Swedish merchants can leverage to gain a growth advantage: Closer integration between physical and online sales channels, the continued growth of digital payments and the variance in international consumer behavior.

There can be little doubt that the corona pandemic has had an enormous and devastating effect on the global economy. But the pandemic also represents a unique opportunity because it has triggered significant shifts in consumer behavior, which have not yet settled into new enduring patterns. Now, the burning question on everyone’s mind is: What happens when the pandemic finally releases its grip on the world?

Analysis of Nets’ comprehensive data and recent consumer research across the Nordic markets not only shows how the pandemic has affected consumer behavior both online and offline, it also provides insights into which of those trends are likely to continue.

The balance has shifted

Across the Nordics, corona has shifted the balance between online and physical purchases, as well as the balance among e-commerce categories. The total online consumption in the Nordic countries decreased by SEK 218 billion compared with last year, from SEK 856 billion to SEK 638 billion. However, this drop is mainly driven by a sharp drop in travel spending while the online purchase of products has exploded. In all Nordic countries, the products category now makes up more than half of all e-commerce (Sweden 70 percent, Denmark 59 percent, Finland 58 percent and Norway 54 percent).

For physical purchases in the Nordics, the groceries category has experienced strong growth due to more consumers staying at home, while other categories such as retail, restaurants & cafés, transport and services have experienced negative growth rates overall, in some cases as much as minus 47 percent.

But some sub-categories within these groups, such as flowers and home improvement have grown significantly, again pointing to the significant changes among consumer patterns. The survey data also clearly shows a strong desire to return to physical shopping among all Nordic consumers.

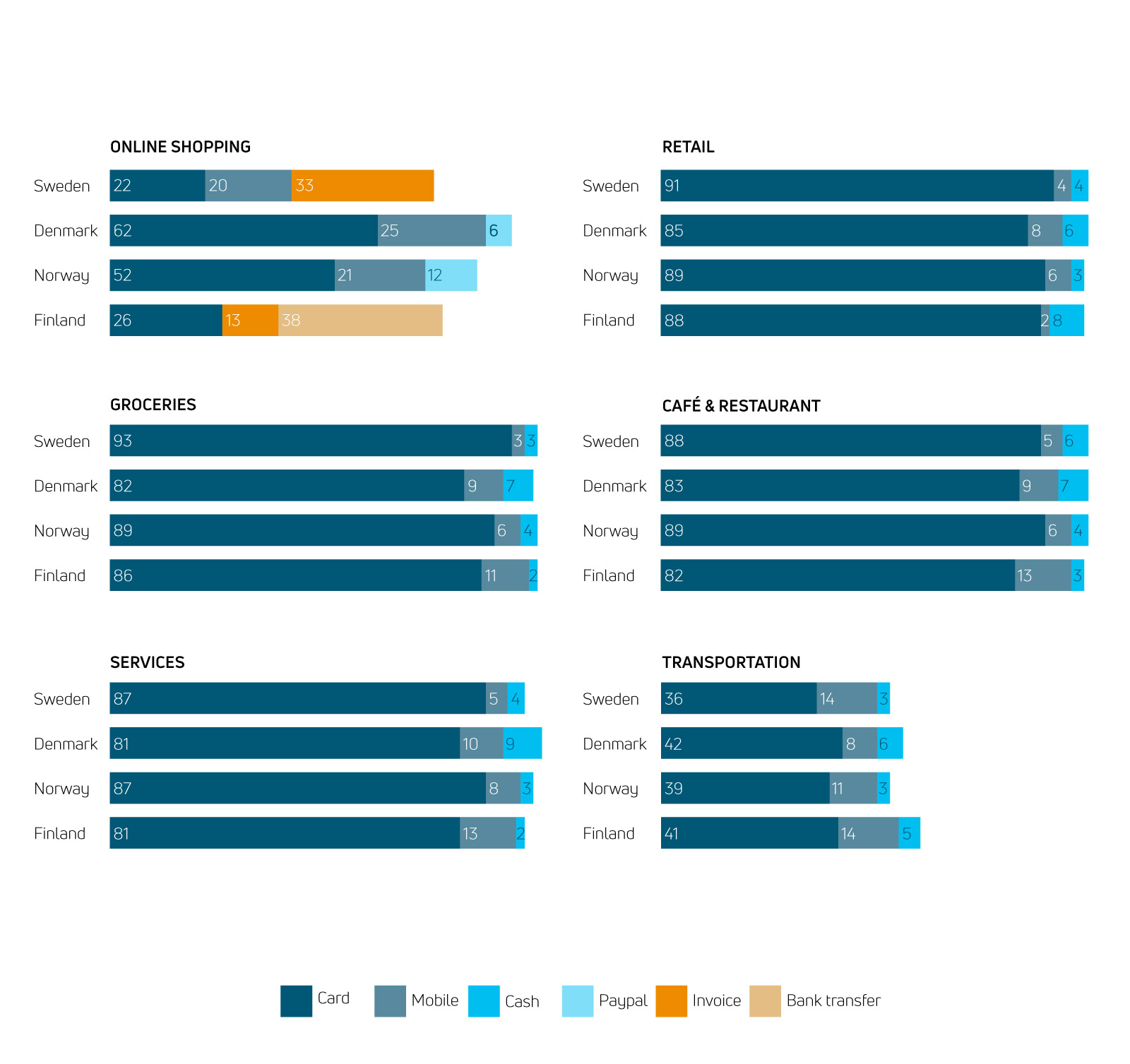

It is also clear that corona has driven cashless payments and accelerated consumer adoption of digital payment methods. In all Nordic countries, mobile, contactless and card payments have increased at the expense of cash, which is now preferred by less than 10 percent of all Nordic consumers (see figure below).

Card is still the Nordic king of both physical and e-commerce payments, driven by the well-established infrastructure for card payments. Card payment is preferred by up to 90 percent of Nordic consumers, mainly because it is considered easy, fast and secure.

Top 3 Nordic payment preferences (%)

Based on these data insights and insights from Nets’ payment experts, there are three key opportunities Swedish merchants should explore, to grow their revenue and improve the customer experience as the world moves beyond corona.

- Insight 1 -

Invest in stronger integration between online and physical sales channels

For years, the global business community has tried to crack the code of unified commerce, where online and physical sales channels integrate seamlessly. Now, there are many indications that corona may have been a driving force in this direction.

On one hand, the widespread lockdowns and fears of infection motivated many consumers to turn to e-commerce when shopping for products, including new customer groups like the elderly. A total of 22 percent of Swedish consumers say they are likely to shop online more often after corona, with a fairly even distribution across all age groups. This indicates that more consumers have overcome significant barriers for shopping online, such as the force of habit and concerns about security.

However, most customers still prefer physical shopping and all over Sweden, customers are eager to return to their favorite stores, restaurants and events. As many as two thirds of Swedish consumers prefer to shop physically versus one third online. One of the main factors for shopping in physical stores is the ability to see and feel the products before purchase, which 48 percent of Swedish respondents list as their top reason for visiting a store.

Providing a strong unified commerce experience is more important than ever before. The winners will be those who manage to provide a seamless experience designed around the customer’s preferences and needs.

For example, online shoppers have long since become accustomed to getting personal recommendations and offers based on data about their previous purchases and personal profile. In the physical space, this experience can be emulated by the use of mobile payment terminals which set the sales staff free from the cash register.

This allows shop staff to accompany customers around the store to provide personal assistance and at hotels guests can pay for room-service on delivery instead of adding it to their room bill for payment at check-out. In other words, meet your customers where they are when it provides a better experience.

For customers who are more comfortable being in full control of their own buyers’ journey, many companies have accelerated the implementation of click-and-collect programs and self-service checkout terminals to create a convenient and frictionless experience.

Digital receipts and loyalty programs are also excellent ways of binding physical and online shopping experience closer together. Digital receipts can make returns easier, regardless of whether the purchase was made online or physically. And loyalty solutions that provide benefits across multiple channels is an effective way for merchants to entice customers to visit both their digital and physical locations. Roughly half of Swedish consumers prefer digital receipts and nine out of ten are part of at least one loyalty program.

- Insight 2 -

Offer varied digital payment options

With the steady decline of cash, which has been going on for years and accelerated by corona for hygiene reasons, it is increasingly vital for businesses to provide digital payment options to accommodate cash-free purchases. 26 % of Swedes never use cash, which is the highest percentage in the Nordics. However, there is far from a universal consensus about digital payment preference across the channels among Swedish consumers, as shown in figure "Top 3 Nordic payment preferences (%)" above.

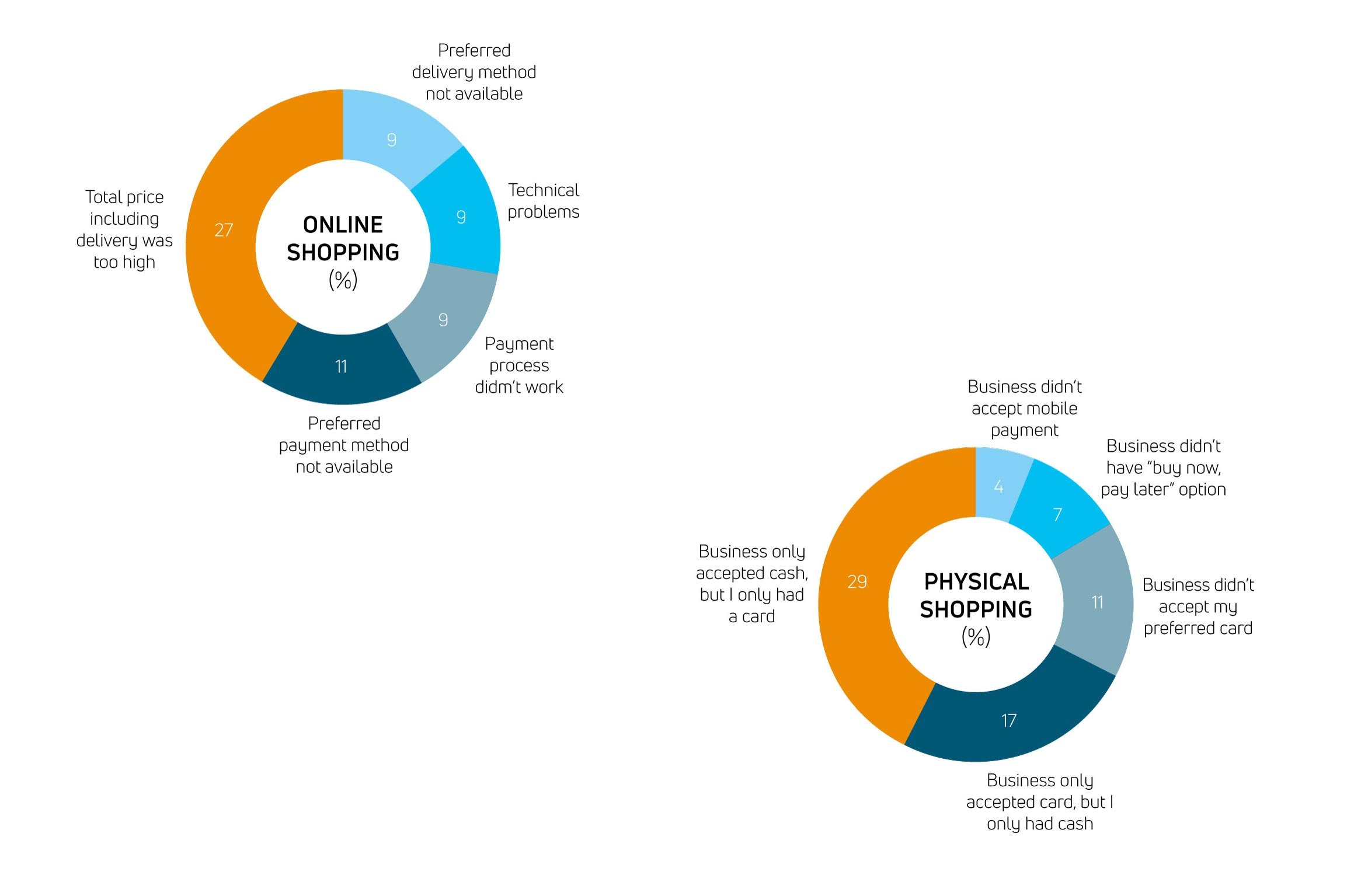

Providing a comprehensive suite of digital payment options is good business sense. Lack of a preferred payment option is the second-most significant reason for dropped online purchases (see figure below). 33 percent of Swedes has interrupted a purchase online and more than one online purchase out of ten was lost because the customer’s preferred payment option was not available. This also applies to physical sales, where lack of a preferred payment option also results in lost sales.

Main reasons for dropped purchase for Swedish consumers (%)

In 29 percent of the dropped purchases, Swedish consumers had to interrupt a purchase because a business only accepted cash and all they had was a card. It’s also worth noting that in 7 percent of the cases, the lack of a “buy now, pay later” option resulted in a lost purchase, especially considering that invoice payment is still the preferred Swedish payment choice for e-commerce, with a third of all consumers wanting this option.

In Sweden, card payment is still a major factor in both physical and e-commerce, but other digital options such as mobile payments are slowly gaining ground. Contactless payment continues to rise in popularity among Swedish consumers. In 2020 alone, contactless payment increased from 44 percent to 62 percent.

The strong cooperation between Swedish banks has also placed Swish in a strong position to compete against international wallets. Swish is preferred by 57 percent of Swedish consumers versus 2 percent for both Apple Pay and Samsung Pay.

- Insight 3 -

Keep international consumer preferences in mind

As travel restrictions lift, physical business can also expect an increase in international customers. In this respect, Swedish merchants should be aware that the Nordics are among the most digitalized markets in the world and that consumer payment preferences vary significantly across different countries.

Most visitors prefer to use their local card such as UnionPay or Alipay for Chinese travelers and American Express for Americans. And in Germany and other parts of Europe, cash is more common than in the Nordics. So, if you cater to an international customer group, accepting several payment types becomes more important.

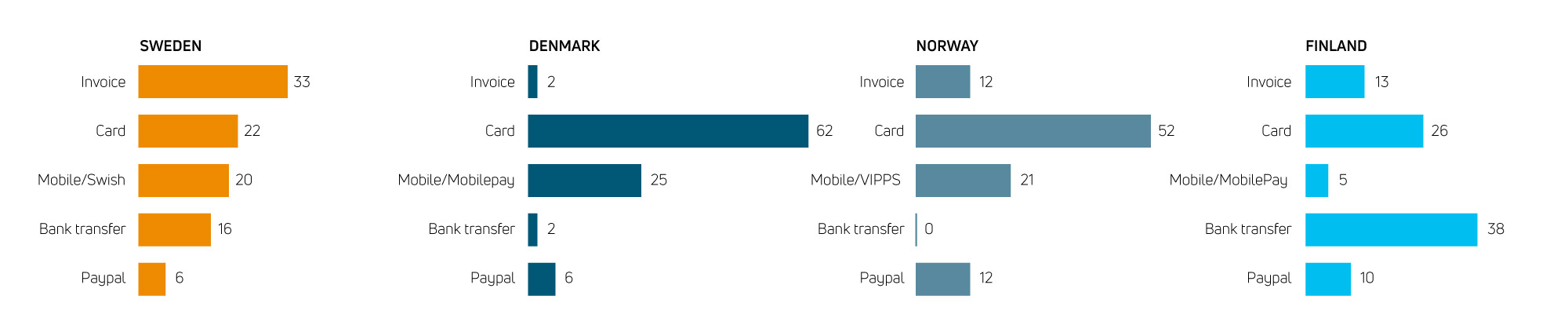

This variance in preferences is even more relevant for e-commerce, where catering to an international customer group is obviously much easier. As a general rule of thumb, accepting card payments from the major international card providers like Visa or Mastercard is still the safest bet, but digital E-wallets, invoice and online bank transfers are also worth considering, depending on which countries the customers are from (see figure below).

Top international preferences for online purchases (%)

How can these insights add value and

growth for Swedish business?

So, what does all this mean for Swedish businesses? First and foremost, that consumer behavior has changed in many ways during the pandemic. Customers will expect business to change as well to accommodate these new preferences. For example, by transforming their “points of sales” to “points of interaction” with more customer service and options. Providing a seamless experience across digital and physical channels through future-proof technology - unified commerce - will ensure that consumers are better served, and thus increases merchants' growth opportunities.

The payment methods also need to be adapted to the consumer preferences. For physical purchases, accepting card payments - of course contactless - is sufficient, but for online payments the picture is more varied. Card - and also invoice for Sweden - are most important, but local mobile payment solutions like Swish, Vipps and MobilePay have also established a strong position online in the Nordics.

Do you want to dive deeper into the data yourself?

All of the data used in this article are available in Nets’ Nordic Payment Report 2020. or Swedish E-commerce report 2020. In these reports, you can get a comprehensive overview of the main payment trends for both physical and online payments as well as expert analysis and an international perspective. You can download both reports and find many more insights from Nets at https://info.nets.se/

Author:

Patrick Höijer

Country Manager for Sweden and Chief Commercial Officer for Large & Key Accounts

Patrick Höijer is Country Manager for Sweden and Chief Commercial Officer for the Large & Key Account at Nets. He has overall responsibility for sales, propositions, marketing and commercial services, enabling our client serving colleagues to provide exceptional service wherever our clients do business.

Patrick has extensive experience within the payments industry and serves as a senior advisor to many of Nets’ largest merchant clients on key strategic issues they face in pursuing growth and expansion in local and international markets. To discuss any of the themes raised in this article, please email: phoij@nets.eu

Nets är en Nordisk betalleverantör med anor sedan 1968 och har haft bolagsnamnet Nets sedan 2010. Vi erbjuder betallösningar för fysiska butiker och onlinehandel samt finansiella tjänster för banker och kreditinstitut.

© 2019 Nets Sweden AB, alla rättigheter förbehållna.