An effective loyalty program is a key feature that market players in retail need to take seriously. In general, loyalty solutions have increased in recent years and are now extremely well-established and popular.

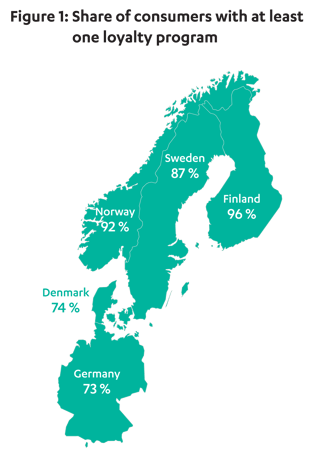

According to new numbers from the upcoming Nets Nordic Payment Report 2022, almost 90 percent of Nordic consumers take part in at least one loyalty program. Most in Finland with 96 percent and least in Denmark with 74 percent. In Germany it is a bit less, 73 percent (see figure 1).

Tapping into this trend can create immense opportunities. In fact, McKinsey research has found that top-performing loyalty programs boost revenue by 15 to 25 percent annually, by increasing purchase frequency and basket size.

With covid restrictions lifted and instore retail getting up to speed again, research shows that the bustling activity have rendered consumers disloyal. The McKinsey study points out that since the beginning of the pandemic, more than 75 percent of US consumers have changed their buying habits and 39 percent have either changed brands or retailers. But the development is not only an American post-pandemic trend. In a global survey from 2019, KPMG assessed that 78 percent of millennials will agree to switch to a company that offers a better loyalty program. And what’s more, 96 percent of millennials believe that companies should find new ways to reward loyal customers.

In the quest to create better loyalty programs, many merchants are trying to create deeper customer relationships with more personalized offers and extensive customer universes. As well as scrapping old, outdated and costly loyalty programs.

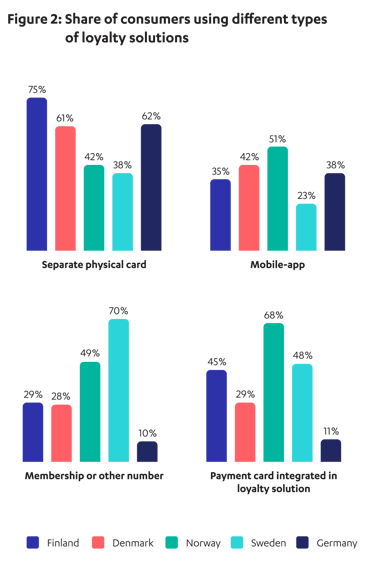

However, traditional loyalty solutions such as plastic loyalty cards or hard-to-remember loyalty numbers still dominate. In Sweden for example, 70 percent of merchants still use membership numbers in their loyalty approach, and in Finland 75 percent of merchants use plastic loyalty cards, according to Nets Nordic Payment Report 2022, which will be published during the fall (see figure 2).

In this article, retail merchants can learn how to get rid of loyalty numbers and separate physical loyalty cards and instead create a modern, state-of-the-art loyalty program – boosting revenue in the process.

From membership clubs to community

In an era of disloyalty, filling the gap of customer connection will prove pivotal to future growth for retail merchants. One of the ways to do this is by building a community on your loyalty platform – establishing a sense of purpose to unite loyalty members around shared causes and interests.

According to Deloitte, leaders in loyalty programs are addressing social value and community through their loyalty offering. However, only 14 percent of loyalty programs are actively encouraging community-building and only 20 percent provide an option for members to participate in a mission they care about. This indicates that there is an opportunity many merchants are overlooking.

Creating an opportunity to redeem rewards for donations or sustainable behavior could be an initial step to take. In addition, you can give members rewards for non-transactional behavior, such as attending an event, leaving a product or service review, downloading the mobile app or referring a friend.

It is also important to create a form of sharing between the customers themselves and not just between the shop and the customer. As a merchant, you can foster this by for example communicating case stories, which are loyal to your brand purpose and to remind the customers why they chose your products in the first place.

Closing the data gap

Loyalty has made it to the table of top management in retail since it is about much more than just making customers return. It is also a major data collection process. And collecting customer feedback, evaluating customer behavior, and analyzing customer sentiment is much easier on your own loyalty platform.

The Deloitte report also found that loyalty leaders today create data-driven, personalized loyalty experiences for their members. The programs range from tailored offers to curated content and messaging. However, less than 25 percent of loyalty programs are personalizing member experiences based on previous interactions, purchase history, and stated or inferred preferences. This leaves ample opportunity for data driven merchants.

With online sales and omnichannel click-and-collect increasing, many merchants have begun to create a true unified commerce platform, to seamlessly collect their customer data from offline to online and vice-versa. However, it can be difficult to bridge offline and online channels, which have traditionally been built on different technologies from multiple providers. Thus future-proofing the platform is an important brick in the puzzle.

One example of a successful instore loyalty solution is a Swedish leading furniture supplier, where the merchant implemented an integrated payment card loyalty solution in its many stores across the country with overwhelming success. After one year in operation, approximately half a million customers had chosen to connect their primary payment card to the merchant's customer member club, corresponding to a growth of 40 percent. The loyalty solution increases the ability to quickly getting new members during purchase. But it also shortens the reward process since the member is identified when using the connected payment card, thus shortening the purchase process.

It is no longer a viable option for many merchants to have e-commerce platforms that are separated from the brick-and-mortar store or mobile apps with no integration. Consumers want — and even demand — seamless navigation from start to finish in all the channels in which they interact with a retailer. They want a multichannel consumer experience throughout the delivery, and retailers must satisfy the consumer expectations to be successful.

Consumers want seamless solutions

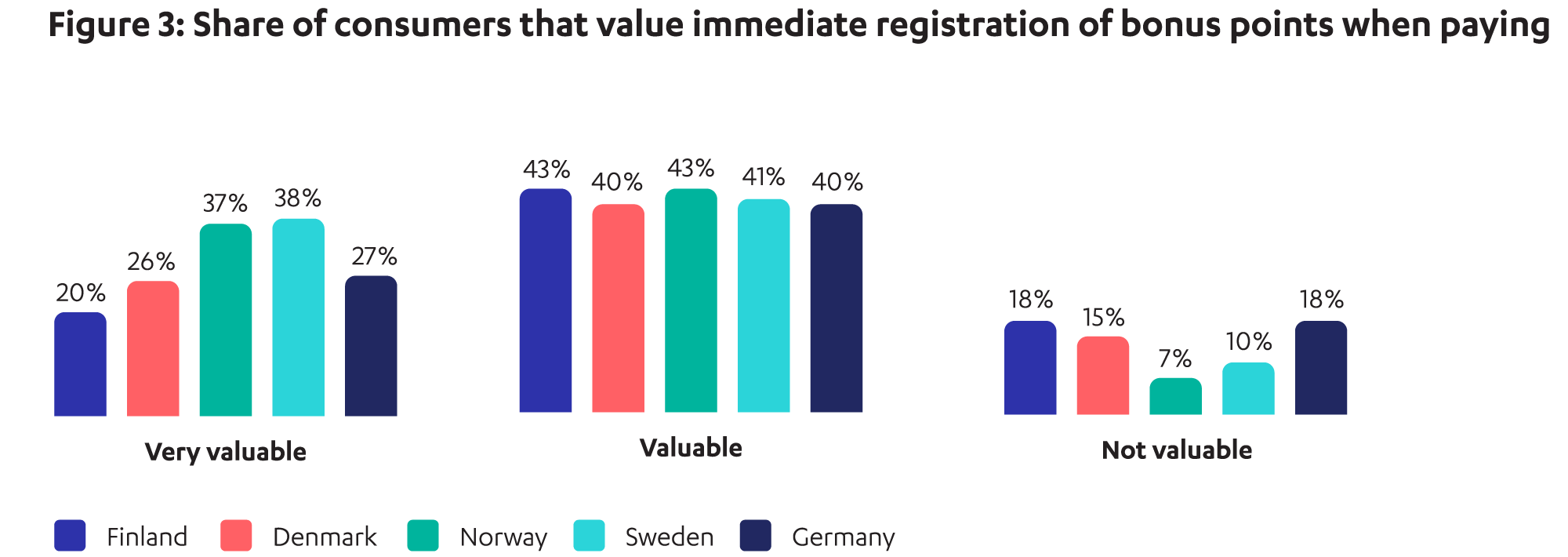

The vast majority of Nordic consumers appreciate solutions where rewards are registered directly with the payment, regardless of the payment method. The same goes for German consumers.

According to Nets Nordic Payment Report 2022, about a third of consumers appreciate this seamless approach very much, which is a clear increase from earlier years.

For stores that offer these modern solutions, there are great opportunities to create more loyal customers. Although the technology adoption is slow, since challenging technical updates, several large chains throughout the Nordics have already implemented solutions, in which the payment card is integrated with the loyalty program and the customer receives bonus points as soon as the purchase is made.

If executed correctly, this approach can empower the physical stores because the unified interaction with online, app and physical stores is blending together in true revenue-creating fashion. It also leads to less waiting in line for people to remember their loyalty numbers, as well as lower costs for separate loyalty programs (see figure 3).

Norway leads the way in digitizing loyalty

The benefits mentioned above naturally creates an incentive for more merchants to digitize their loyalty programs. This is a positive development, since it is likely that loyalty programs not connected to payment cards or such so called tokenization, will soon be regarded as cumbersome and dull.

According to the new numbers from the Nordic Payment Report 2022, Norway is leading the way in digitizing loyalty solutions with 51 percent of consumers using a mobile app. Sweden takes last place with 23 percent. In Germany, 38 percent use a mobile app for their loyalty solution.

Norway again takes the lead when it comes to the share of consumers having their primary payment card integrated in a loyalty solution – with a whopping 68 percent. Here, Sweden comes in second with 48 percent. Germany takes last place with a mere 11 percent, since using payment cards still lag behind the Nordic countries. Nevertheless, the future of loyalty has arrived in the Nordics, leading the way in these digital matters.

In the digitization process, it is important to be mindful of building trust, getting consent, and staying compliant to privacy regulation. Customers get annoyed by poorly executed personalization, and in the end, it can have detrimental effects for not only your loyalty program, but also your business as a whole.

The future of biometrics

Biometrics are still somewhat of a joker when it comes to the future of loyalty. While it can ease the payment process, there are also security concerns with biometrics, if compromised.

Also noted in the Nordic Payment Report 2022, approximately four out of ten consumers are still reluctant to using biometrics as authentication for the payment. That said, biometrics are likely going to become more common, but further down the road. As with many other new technologies, the change will be gradual and often powered by convenience.

Three concluding tips for merchants

- Insight 1 -

Make loyalty seamless

The first step to create a powerful loyalty program is to integrate a so-called tokenization, meaning for example connecting the loyalty in the primary payment method – such as payment cards – in the physical stores. Stop thinking about loyalty as something separated from the normal shopping experience – it needs to be closely integrated to the shopping and payment. Implementing a platform that can handle this allows merchants to scrap the need for separate loyalty cards or long membership numbers – and start the journey to create a true unified commerce. With this approach, merchants can also gather comprehensive data about shopping behavior and create a truly seamless loyalty program, which increases purchase frequency and potentially also basket size.

- Insight 2 -

Build a community

One of the most current popular approaches to designing an engaging loyalty program is to unite customers around their shared interests, by building a platform that allows for customers to engage with their peers and/or for a cause. Feeling a sense of purpose in one’s loyalty program can deepen the feeling of belonging and heighten the members’ emotional connection to your brand.

- Insight 3 -

Use data to personalize the experience

Retail players should utilize this new data to personalize the loyalty program for members, both instore and online. While e-commerce has massive data collection potential, physical presence can be added through modern instore solutions, and should be used to create impressive experiences which attracts the desired consumer segments. In addition, there are many technological options for obtaining data from physical stores, improving data collection to personalize and boost your loyalty program. All secured and customer first, of course. Trust is key.

Author:

Jeppe Juul-Andersen

Chief Commercial Officer, Large & Key Account at Nets Group

Jeppe Juul-Andersen is Chief Commercial Officer for the Large & Key Account segment at Nets Group and has overall responsibility for sales, propositions, marketing and commercial services, enabling our client-serving colleagues to provide exceptional service wherever our customers do business.

Jeppe has extensive knowledge of the payments industry and serves as a senior advisor to many of Nets’ largest merchants on key strategic issues they face in pursuing growth and expansion in local and international markets. To discuss any of the themes raised in this article, please email: jeppe.juul-andersen@nexigroup.com

Nets är en Nordisk betalleverantör med anor sedan 1968 och har haft bolagsnamnet Nets sedan 2010. Vi erbjuder betallösningar för fysiska butiker och onlinehandel samt finansiella tjänster för banker och kreditinstitut.

© 2019 Nets Sweden AB, alla rättigheter förbehållna.